What is a 1031 exchange?

Section 1031 of the Internal Revenue Code of 1986 allows real estate investors to defer the capital gains tax that would normally be due from the sale of an investment property. In order to defer such taxes, an investor must perform a 1031 exchange by reinvesting the proceeds from a relinquished investment property into other “like-kind” investment property. By deferring taxes with a 1031 exchange, investors are able to use all of the proceeds from the sale of their relinquished property, giving them greater purchasing power to buy the replacement property.

Examples of “like-kind” real estate:

- Residential rental property

- Multifamily (apartments)

- Commercial properties: office, retail, industrial & more

- Vacant land

- Farmland

- a business owner’s own building

- DSTs: a beneficial interest in a Delaware Statutory Trust that holds any type of like-kind property

Note: Properties and investment products that do not qualify as like-kind property and therefore will not qualify for a Section 1031 exchange include Real Estate Investments Trusts (REITs), real estate funds, one’s primary residence, vacation homes or second homes held primarily for personal use. However, vacation and second homes may fall under safe harbors under certain circumstances.

Request a Free Investor Kit

*All Information is Secure & Confidential.

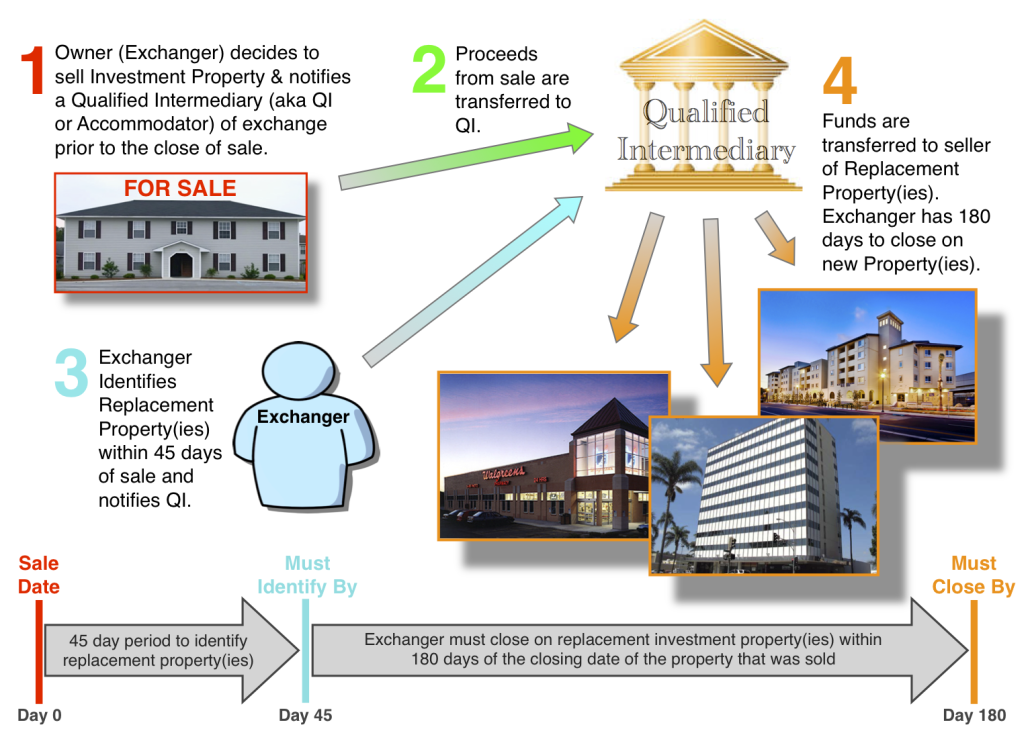

1031 Exchange Guidelines

Please consult your tax advisor regarding your 1031 Exchange.

- The seller cannot take receipt of the sale proceeds. Instead, the sale proceeds must go directly to a third party Qualified Intermediary.

- Replacement property in a 1031 Exchange must be “like-kind” to the relinquished property.

- Replacement property in a 1031 Exchange must be identified within 45 days from the sale of the original property.

- Replacement property in a 1031 Exchange must be acquired within 180 days from the sale of the original property.

- Equity or cash invested in the replacement property must be equal to or greater than the cash received from the sale of the relinquished property.

- Debt or leverage placed on or assumed on the replacement property must be equal to or greater than the debt that was previously held on the relinquished property.

Diagram – How Does a 1031 Exchange Work? (InfoGraphic)

Property photos are only representations and are not actual photos of properties in a 1031 Exchange.

What is a Qualified Intermediary?

A Qualified Intermediary (aka “QI” or “Accommodator”) is a third-party firm that is dedicated to facilitating Section 1031 tax-deferred exchanges. Treasury Regulations define the role of a QI. The exchanger in a 1031 exchange should enter into a written agreement with a QI prior to the close of sale of their relinquished property. At the time of the close of sale of the relinquished property, the QI will take receipt of the proceeds paid by the buyer of the relinquished property, at which time the QI will then transfer title of the relinquished to the buyer. The QI then holds the exchanger’s funds in a trust or escrow account because the exchanger may not take receipt of the funds. Once the replacement property has been identified and purchased by the exchanger, the QI will transfer the exchanger’s funds to the seller of the replacement property.

It should be noted that individuals who acted as employees or advisors to the exchanger within the last two years are disqualified from serving as the Qualified Intermediary. Such advisor roles include accountants, attorneys, investment bankers, brokers, or real estate brokers.

How is Replacement Property Identified for a 1031 Exchange?

Replacement property “identification” must be submitted to a Qualified Intermediary by way of a signed written document known as an “Identification Notice.” Below are the three identification rules that the exchanger may choose to follow:

- The Three Property Rule: The exchanger may identify up to three properties, regardless of the value of those properties. The exchanger may then purchase one, two or three of those properties as replacement properties.

- The 200% Rule: The exchanger may identify any number of properties as long as the total value of all of the properties identified does not exceed 200% of the total value of all of the relinquished properties.

- The 95% Rule: The exchanger may identify any number of properties, regardless of their value, as long as the exchanger purchases 95% of the value of the properties identified.

What is a 1033 Exchange?

A 1033 Exchange has different rules than a 1031 Exchange. A 1033 Exchange may be possible when an “involuntary conversion” of the relinquished property occurs. Involuntary conversions include natural disasters and losses by way of eminent domain. Taxes are due on any gains that are recognized from the proceeds awarded from such conversions, unless the receiver of the awarded proceeds (the previous owner of the property) decides to defer the recognition of those gains by completing a 1033 exchange. Although similar to a 1031 exchange, a 1033 exchange has a two very distinct differences:

- The exchanger may take receipt of the funds, which means that there is no need for a qualified intermediary.

- The exchanger has up to two, three, or more years to identify replacement property and reinvest the proceeds. The length of this period depends on the specific circumstances relating to the involuntary conversion.

This is neither an offer to sell nor a solicitation of an offer to buy any security which can only be made by prospectus or private placement memorandum. Investing in real estate and 1031 exchange replacement properties may not be suitable for all investors and may involve significant risks. These risks include, but are not limited to, lack of liquidity, loss of principal, limited transferability, conflicts of interest and real estate fluctuations based upon a number of factors, which may include changes in interest rates, laws, operating expenses, insurance costs and tenant turnover. Investors should also understand all fees associated with a particular investment and how those fees could affect the overall performance of the investment. Employees of DST Properties, Inc. and DFPG Investments, Inc. do not provide tax or legal advice, as such advice can only be provided by a qualified tax or legal professional, who all investors should consult prior to making any investment decision. DST Properties, Inc. is a branch office of DFPG Investments, Inc. Securities offered through DFPG Investments, Inc. Member FINRA/SIPC.